Global Insurtech

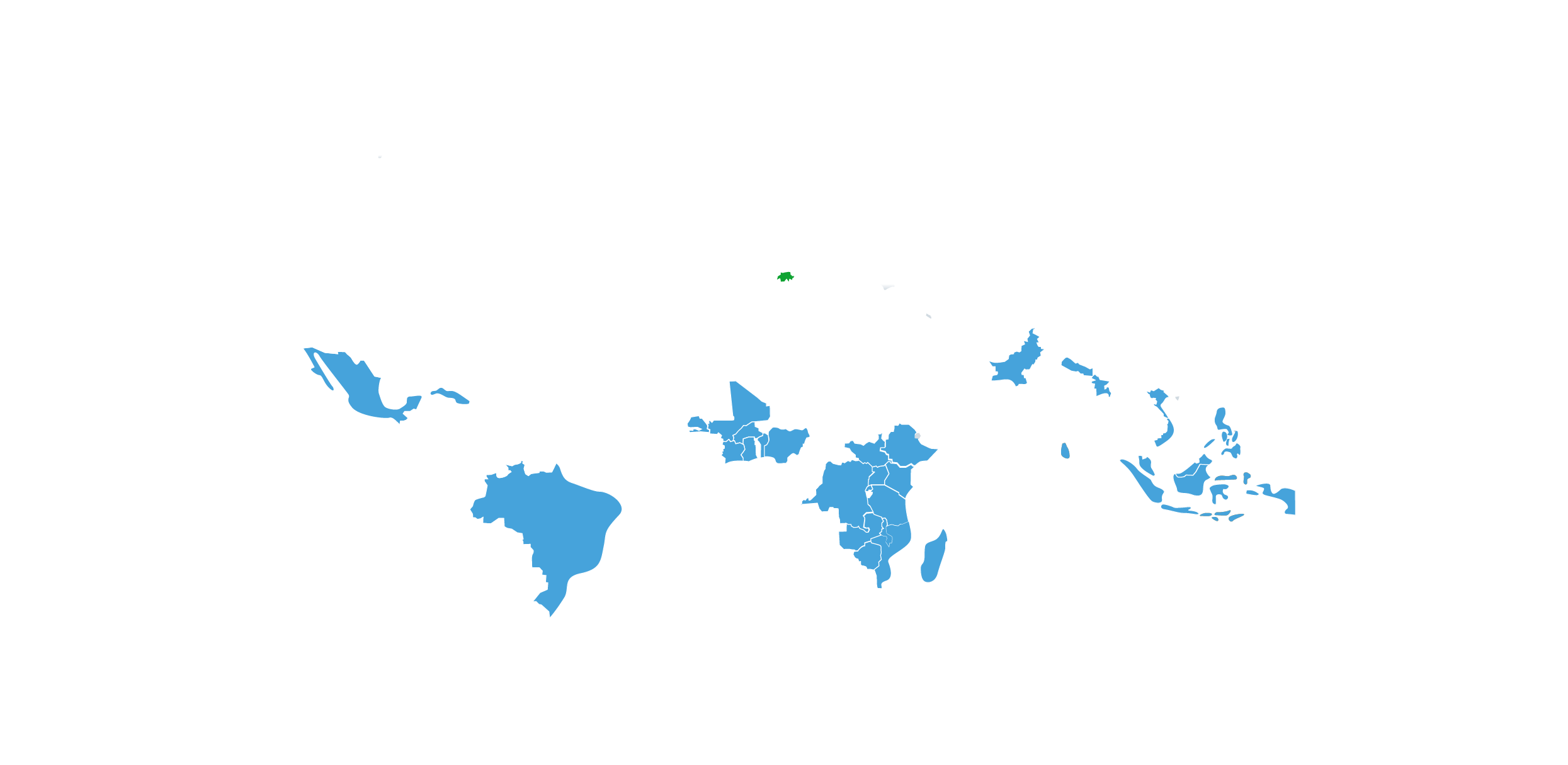

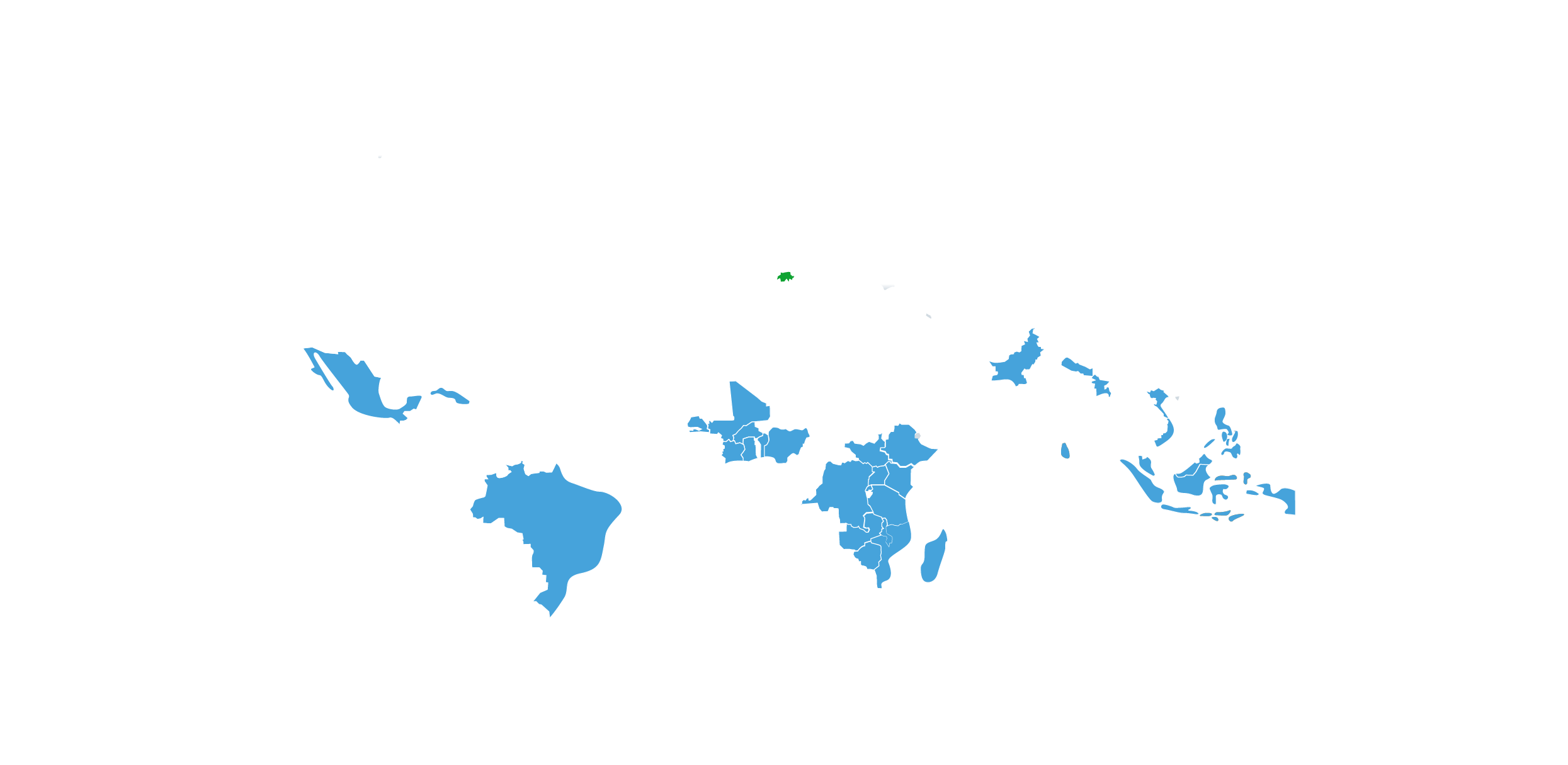

Pula is an agricultural insurance and technology company that designs and delivers innovative agricultural insurance and digital products to help smallholder farmers endure yield risks, improve their farming practices, and bolster their incomes over time.

SUM INSURED ($)

GROSS PREMIUMS ($)

FARMERS INSURED

HECTARES INSURED

PAYOUTS ($)

FARMERS PAID

SUM INSURED ($)

GROSS PREMIUMS ($)

FARMERS INSURED

HECTARES INSURED

PAYOUTS ($)

FARMERS PAID

Achieved over 5 years

Achieved over 5 years

We are backed by top tier Investors and Partners.

Our success and impact has been featured by Global media outlets.

We are backed by top tier Investors and Partners.

Our success and impact has been featured by Global media outlets.

We have won prestigious awards for our innovative products and impact.

We have won prestigious awards for our innovative products and impact.